Industry leader Petron Corporation had a robust end to 2023, posting a consolidated net income of P10.1 billion, 51% higher than the P6.7 billion reported in 2022.

Fueled by its wide presence and effective volume-generation strategies in the Philippines and Malaysia, the company delivered a combined sales volume of 126.9 million barrels for the year, 13% higher than the 112.8 million barrels sold in 2022. The Group’s strong volume performance was driven by the significant growth in its Jet Fuel and LPG sales backed by higher production at its Bataan and Port Dickson refineries.

Under its Philippine operations, Petron sold 79.5 million barrels in 2023, higher than 2022’s 68.5 million barrels. The company fortified its leadership in the Retail, Industrial, and LPG markets supported by the sustained economic recovery and Petron’s effective marketing strategies.

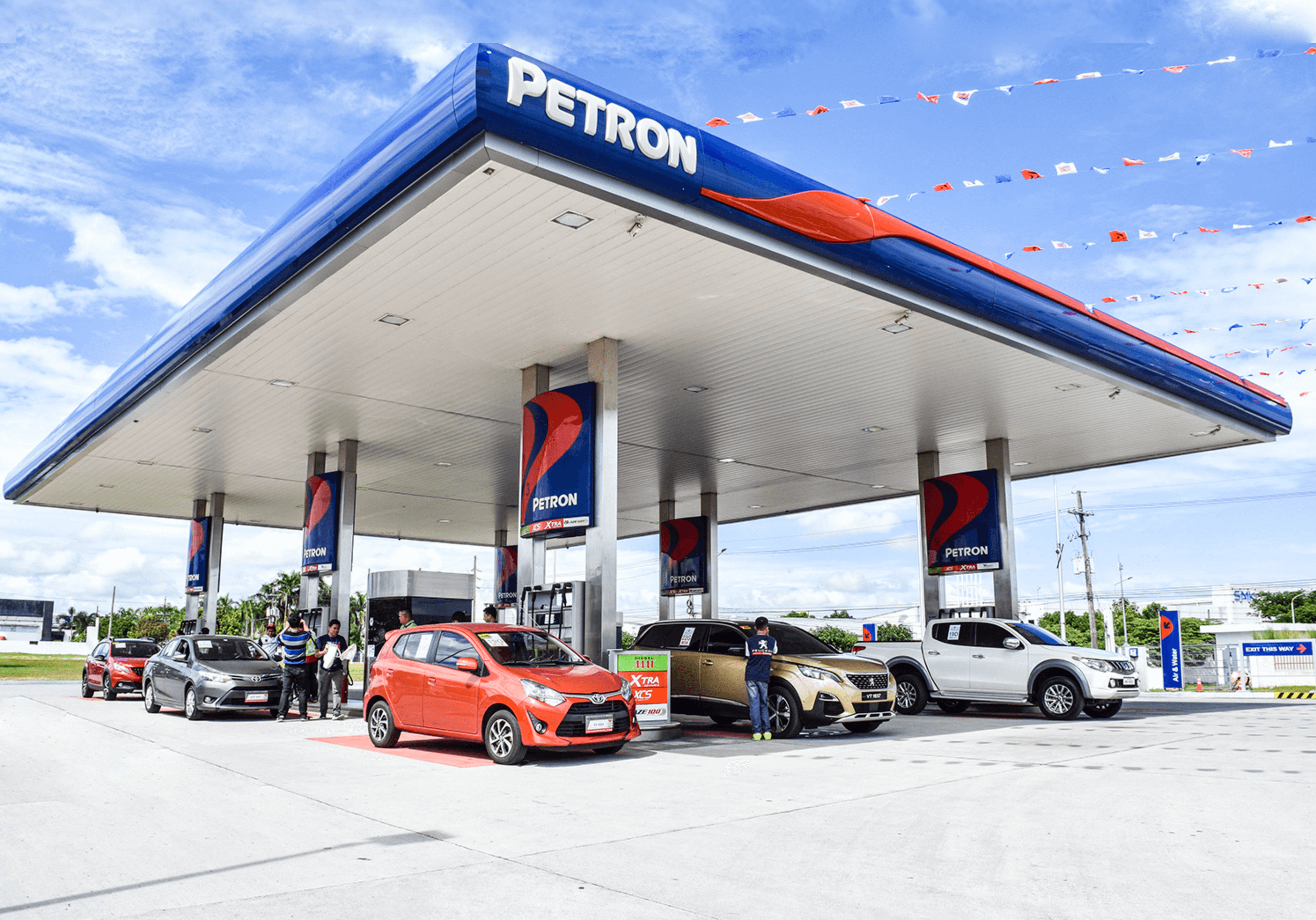

Petron’s local industrial sales were driven mainly by the more than 50% growth in Jet Fuel as it cornered about 80% of the market in 2023. Domestic LPG sales rose 26% year-on-year on the strength of Petron’s LPG brands, Petron Gasul and Fiesta Gas. In the highly saturated and price-driven retail sector, sales went up by 15% resulting from the company’s efforts to increase the competitiveness and productivity of its service station network, which remains the widest in the country. Overall, Petron grew its overall market share to 24.5% in the first half of 2023 according to the latest available data from the Department of Energy (DOE).

Despite higher sales volume, Petron recorded lower revenues settling at P801 billion, slipping by 7% from the previous year’s P857.6 billion as prices continued to correct from their record-high levels in 2022. The full year average price of benchmark Dubai crude stood at $82 per barrel in 2023, down 15% from $96 in 2022.

Petron’s continuing efforts to capture the continued demand recovery, optimize assets and resources, and respond to market volatility resulted in a 60% improvement in its operating income, which reached P30.7 billion coming from last year’s P19.2 billion. The upswing in the financial results came at a time of persistent geopolitical conflicts and global inflationary concerns pressuring the market.

“Our strategy to capture the economic resurgence and minimize external pressures played a key role to our success. While challenges remained, our company managed to deliver significant improvements in high-demand sectors. We are committed to strengthen these efforts, among other initiatives that will not only solidify our recovery but will also take us further ahead in nation-building.” said Petron President and CEO Ramon S. Ang.

Recently, Petron was recognized by the Bureau of Customs (BOC) for being one of the country’s top importers in 2023 based on payment of duties and taxes, significantly contributing to the Bureau’s positive collection performance. The company likewise remains the leading contributor to the government’s fuel marking program since it took effect in 2019. For 2024, Petron is poised to reinforce its growth and nation-building efforts including the expansion of its retail and logistics network, side by side with its sustainability endeavors.

“We look back on 2023 with pride as we celebrated our 90th year. We made much progress in the things we sought to accomplish like our financial recovery and further expansion. Looking ahead, we are inspired to be more responsible, accountable, and sustainable as we continue to grow our business,” said Ang.